KPE Solutions | Tax Planning, Compliance Strategies & Wealth Preservation

Smart Tax Strategies To Keep More Of Your Hard-Earned Money

Let’s be real—taxes aren’t just a yearly headache; they’re one of the biggest expenses for any business. And if you’re not proactively managing your tax liability, you’re probably not leveraging opportunities for tax-savings.

Whether you’re an individual filer or small business owner, KPE Solutions helps you file with clarity, confidence, and maximum savings.

Want to stop overpaying and start keeping more of your money? Let's build a Smarter Tax Strategy

KPE TAX SERVICES

Tax Support That Works for You

KPE Solutions helps individuals, solopreneurs, and small business owners simplify tax season and keep more of what they earn. We offer:

Because handing everything to your accountant in April and hoping for the best isn’t a tax strategy

(If You’re Guessing, You’re Probably Overpaying)

Most business owners assume taxes are just another expense they have to deal with—but that’s a costly mistake. We proactively help you plan for ways to reduce what you owe, legally and efficiently.

Think you’re paying too much in taxes? Let’s review your situation.

(Is Your Business Structured the Right Way)

Your business structure doesn’t just impact your legal protection—it directly affects how much you pay in taxes. If your entity setup isn’t optimized, you could be leaving thousands on the table.

(Making More Money Shouldn’t Automatically Mean Doubling Your Tax Bill)

When your business crosses six or seven figures, your tax strategy needs to scale with you. Without proactive planning, your tax bill will grow just as fast as your revenue.

Think you’re paying too much in taxes? Let’s review your situation.

(Because the IRS Isn’t Just Going Away)

If you’ve received an IRS notice, are worried about an audit, or need to resolve back taxes, we can help you navigate the mess and get back on track—without the stress.

Need help dealing with an IRS issue? Let’s handle it before it gets worse.

Your Tax Situation Deserves More Than Just Filing

KPE Solutions combines automation + strategy to help W-2 earners, gig workers, and business owners get organized, stay compliant, and maximize what they keep — not just file.

More Than a Tax Prep Service — We’re Your Tax Efficiency Partner

Unlike traditional firms, we use smart automation to eliminate guesswork and save time. Our AI-powered systems help us gather your info quickly, identify deduction opportunities, and flag missing items. PTIN-registered tax preparer with over 20 years of professional expertise. All tax clients receive our KPE Tax checklist + AI-powered support.

WHAT SHOULD I DO FIRST?

START WITH KPE TAX CHECKLIST

Get organized in < 5 minutes

GET A SUMMARY

You'll get a summary to print or submit for filing to any tax preparer or let KPE handle it

WE HANDLE THE REST

Simple. Smart. Tax filing, without the stress. Let us do the heavy-lifting

About KPE Solutions

KPE Solutions helps individuals and small business owners increase profits, reduce costs, and save time with smarter tools and strategic business support — including tax preparation, tax credit screening, bookkeeping, and done-for-you automation powered by our KPE SmartFlow™ system. Whether you're filing on your own, need full-service help, or want to streamline your business, we make it easier to file, plan, and grow — all in one place.

How KPE Tax Solutions Helps You

Not Sure Where to Start? Use our free KPE Tax Checklist to get organized in minutes — and know exactly what you need to file. Whether you file solo or with a pro, it’s the easiest way to get started.

Frequently Asked Questions

KPE Solutions offers full-service tax preparation for individuals, self-employed professionals, and small business owners. We also provide tax credit screening, strategic tax planning, and bookkeeping support to help you maximize deductions and reduce liabilities.

Yes. We screen every eligible client for the Self-Employment Tax Credit (SETC) and other tax incentives. You don’t need to guess — we help you find out what you're eligible for and how to claim it. What if I need help after I file? We offer optional extended support packages that include audit protection, IRS notice response, and ongoing help year-round. You’ll get peace of mind knowing support is available beyond tax season. Is KPE Solutions a CPA firm? No — KPE Solutions is not a CPA firm. We operate as a tax-smart consulting business that partners with licensed professionals when needed. Our focus is helping you organize, plan, and prepare your taxes using modern tools and a strategic approach.

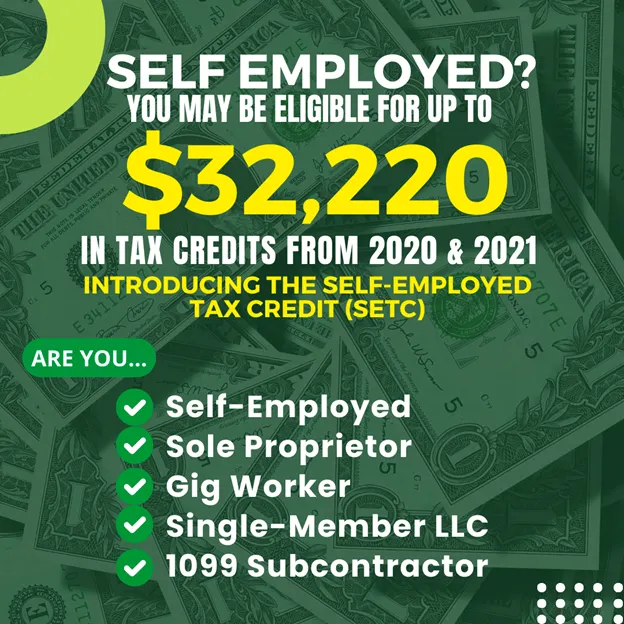

Tax Solutions: Self-Employment Tax Credit (SETC)

If you were self-employed during 2020 or 2021, you may be eligible for the Self-Employment Tax Credit (SETC) — a powerful but often overlooked credit designed to reimburse business owners who couldn’t work due to COVID-related circumstances.

KPE Solutions has collaborated with an experienced CPA firm to help you determine your eligibility and file before the April 15th deadline.

The SETC deadline has passed but you still may have options!

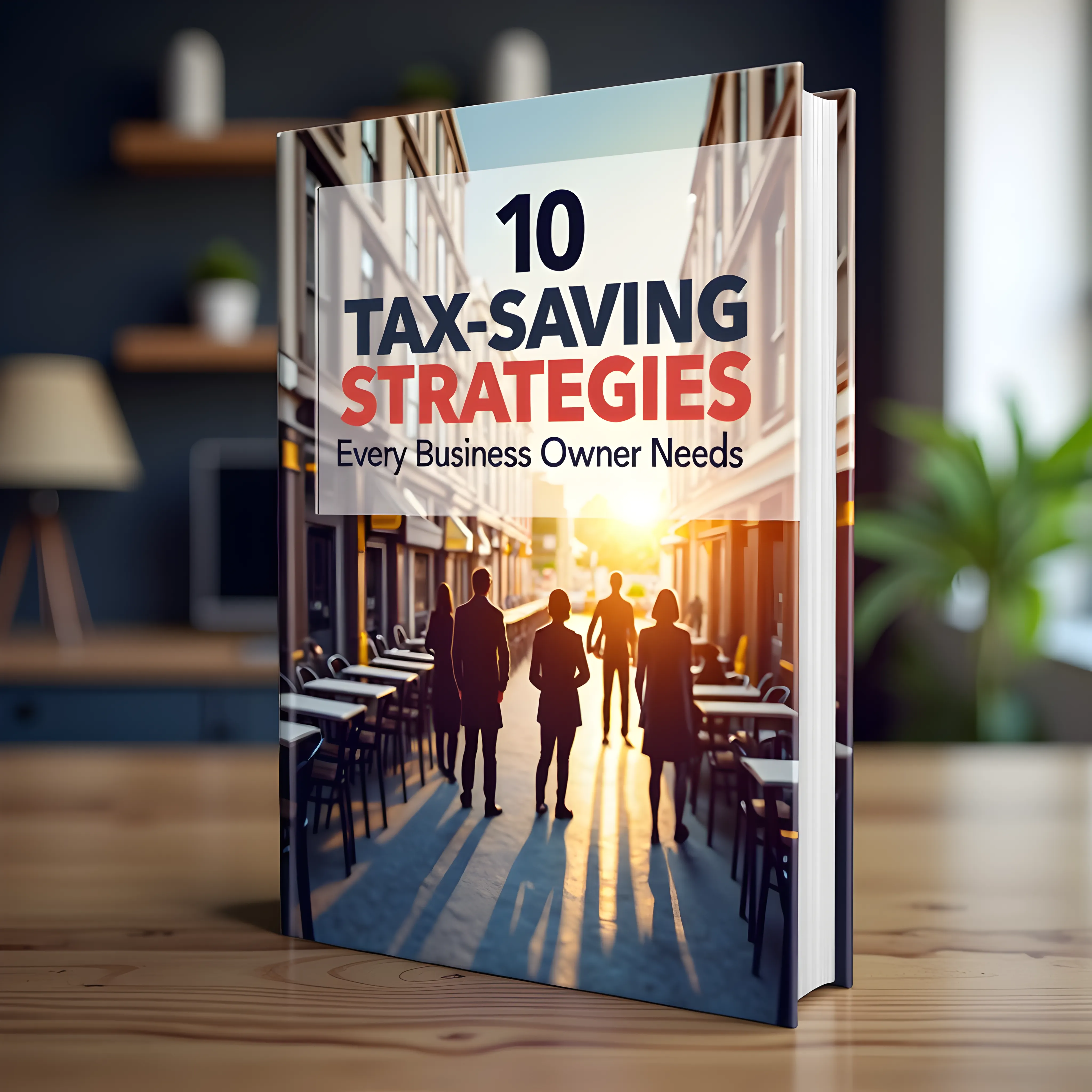

10 Tax-Saving Strategies Every Business Owner Needs

Stop overpaying in taxes and start keeping more of your hard-earned money—legally.

-

The #1 mistake business owners make that costs them thousands

-

How to legally reduce your tax bill every year

-

Which deductions and credits you may be missing

-

Entity structuring strategies that maximize tax savings

Ready to File — or Just Get Organized?

See how we can simplify your taxes

Start KPE Tax Checklist

Let's Talk About It

Want to Learn Tax Prep, No Experience Required?

Become A KPE Tax Affiliate & Start Earning

Whether you're a natural connector, social sharer, or just someone people turn to for useful information — you already have the skills to succeed. As a KPE Tax Affiliate, you’ll help people get their taxes done — ethically and professionally — while earning income and complimentary travel for doing something that genuinely matters.

No tax experience is required. You’ll get access to simple tools and training that show you how to share helpful resources, make a difference in your community, and turn everyday conversations into flexible income — all without long hours, selling, or certifications.

Subscribe to our newsletter -

Ask us about featuring your business to our audience

KPE SOLUTIONS © 2025 All Rights Reserved.